Renowned for its groundbreaking solutions and prominent position in consulting, technology services, and digital transformation on a global scale, Accenture has established itself as a significant player not only in innovation but also in the stock market arena.

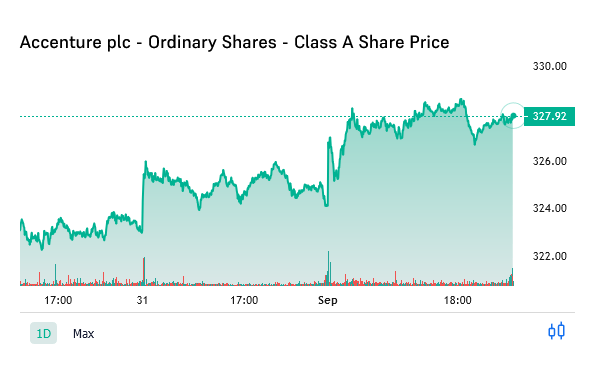

Keeping a close watch on the fluctuations of Accenture’s share price offers investors, stakeholders, and those interested in the market a precious vantage point to assess the company’s fiscal well-being, prevailing market emotions, and holistic achievements.

Within the confines of this article, we explore the intricate factors that exert their influence on Accenture’s share price, concurrently investigating the recent patterns that are instrumental in shaping its intrinsic value.

Factors Influencing Accenture Share Price:

- Earnings Reports: The release of quarterly and annual earnings reports significantly impacts Accenture share price. Elevated market optimism has the potential to drive up valuations, irrespective of the company’s consistent operational performance.

- Market Sentiment: Broader market trends, investor sentiment, and economic conditions can influence Accenture’s share price. Positive market sentiment can lead to higher valuations, even if the company’s specific performance is consistent.

- Technological Innovation: Given its tech-centric nature, Accenture’s share price is susceptible to shifts driven by progress in domains such as cloud computing, artificial intelligence, and digital transformation. Investor interest can be piqued, and the stock can receive a positive boost due to the allure of pioneering solutions.

- Client Acquisitions and Contracts: Winning significant client contracts or making acquisitions can boost investor confidence in Accenture’s growth prospects, potentially leading to an increase in share price.

Recent Performance Trends

In recent years, Accenture’s share price has showcased noteworthy trends:

- Steady Growth: Accenture’s share price has consistently grown over the past few years, reflecting the company’s strong performance and ability to adapt to changing market dynamics. Similarly, the oracle share price has grown steadily since its inception.

- Digital Emphasis: The increasing importance of digitalization in various industries has positively influenced Accenture’s share price. The company’s expertise in helping businesses navigate digital transformation has driven its stock performance.

- Earnings Resilience: Accenture’s ability to deliver consistent earnings growth, even in challenging economic conditions, has contributed to its share price resilience.

Analyst Projections and Recommendations

Financial analysts often provide projections and recommendations for Accenture’s share price:

- Price Targets: Analysts provide estimated price targets based on financial models, market trends, and the company’s prospects. These projections offer investors insights into potential future valuations.

- Buy/Sell/Hold Recommendations: Analysts may recommend buying, selling, or holding Accenture’s stock based on their assessment of its current valuation and future prospects.

Conclusion

Analyzing Accenture’s share price involves considering various factors that impact the company’s stock performance. From earnings reports to technological advancements, each facet plays a role in determining the share price trajectory.

As Accenture continues to innovate and adapt to changing market demands, its share price will remain a focal point for investors and market enthusiasts alike.